management earnings forecasts

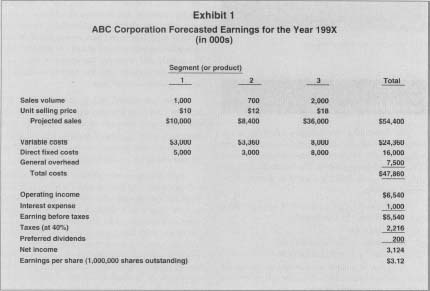

This result does not support the practitioners criticism that providing short-term management earnings forecasts increases earnings management. To predict earnings most analysts build financial models that estimate prospective revenues and costs.

We find that firms tend to issue management earnings forecasts and convey good news before bank loan initiation.

. We find evidence that both MEFs and EAs have an effect on the market. Earnings-focused decisions Decisions taken by the management are solely focused on meeting earnings estimates. Management forecasts issuance within a nine-month period prior to the loan activating quarter can lower the subsequent loan spread by 1406 basis points.

Earnings forecasts are based on analysts expectations of company growth and profitability. Instead it suggests that providing management earnings forecasts can reduce information asymmetry between managers and external shareholders thereby constraining managers opportunistic behaviors. Collectively our empirical results suggest that having major government customers has a positive impact on the quality of MEFs.

We use this fact to examine the shipping industry where most firms voluntarily issue earnings forecasts during the IPO process thus providing unique international-level evidence. Management Earnings Forecasts as a Performance Target in Executive Compensation Contracts Shota Otomasa Atsushi Shiiba and Akinobu Shuto Journal of Accounting Auditing Finance 2017 35. We find overall pessimistic forecasts of ship owners primarily because of the industrys uncertain and volatile environment.

Management earnings forecasts have received much research attention because under specific circumstances this information can signal the direction of long-term performance of IPOs. 2 We keep only point and closed-range forecasts in the sample and exclude open-range and qualitative estimates. Earnings management is the use of accounting techniques to produce financial reports that present an overly positive view of a companys business activities and financial position.

More importantly evidence suggests that prior studies finding of weaker stronger stock-price responses to forecast revisions in the period immediately after before the prior-quarter earnings announcement disappears once management earnings forecasts are. We collect management forecasts of quarterly earnings from the First Calls Company Issued Guidance CIG database for the period 19962010. Earnings forecasts convey timely information about the macroeconomic state.

In this paper we provide a framework in which to view management earnings forecasts. A Review and Framework. Moreover when managers disclose negative information to the market earnings forecasts issued by government suppliers have greater price impact than those issued by corporate suppliers.

Specifically we categorize earnings forecasts as having three componentsantecedents characteristics. This thesis examines the stock markets assessment of corporate earnings and management earnings forecasts MEFs. In this study we investigate the trading behavior of institutional investors in China according to management earnings forecasts MEFs and earnings announcements EAs.

Understanding the Role of Management Earnings Forecast Range Speaker Marlene Plumlee David Eccles School of Business University of Utah Add Share on Abstract In this study we examine the association between the range-related news in range management earnings forecasts MEF and analyst and investor reactions to those forecasts. The most commonly used strategies are as follows. Management earnings forecasts provide the capital market with private information about the companys operations and help to mitigate the degree of information asymmetry with investors thus.

The easiest way for earnings management is to control the companys expenses. First I find that management EPS forecasts improve the degree to which returns reflect future-period earnings measured using the future earnings response coefficient FERC. We find that management earnings forecasts influence the timing and precision of analyst forecasts.

Management Earnings Forecasts. Earnings Management Approaches Companies use several strategies used for earnings management. Specifically we include 1 a variable based on the difference between the markets expectation of the range of expected earnings prior to when the mef was issued and the mef range range-width news and 2 indicator variables that capture when the median consensus analyst forecast is above below the upper bound lower bound of the mef.

More importantly we identify several factors that influence this relation. MEFs are mandatory under the stringent regulatory framework in China. The working assumption in the voluntary disclosure literature is that managers have private in- formation which is strategically communicated to investors and analysts via voluntary disclosures like management earnings forecasts.

Issuing firms enjoy more favorable contracting terms and attract more lenders. For comparability we only investigate EPS forecasts. There are a number of studies that shed light on inefficiencies in the IPO market.

Hirst Lisa Koonce Shankar Venkataraman. 1 139-167 Download Citation If you have the appropriate software installed you can download article citation data to the citation manager. Based on a relatively large hand-collected sample of 900 management earnings forecasts we find that disaggregation increases analysts sensitivity to the news in managers earnings guidance suggesting that analysts find the guidance more credible.

Stock Forecast Best Sale 51 Off Www Ingeniovirtual Com

Rationality And Analysts Forecast Bias Lim 2001 The Journal Of Finance Wiley Online Library

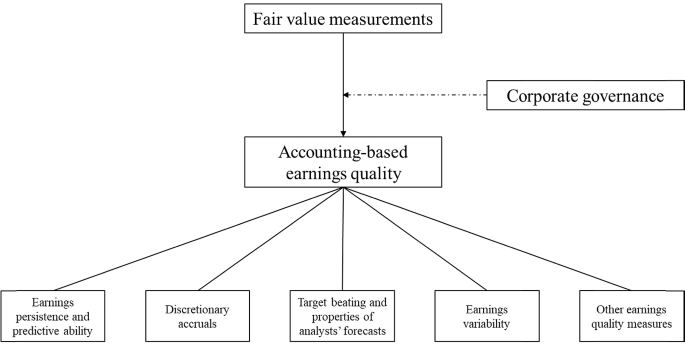

Do Fair Value Measurements Affect Accounting Based Earnings Quality A Literature Review With A Focus On Corporate Governance As Moderator Springerlink

Ceo Ability And Management Earnings Forecasts Baik 2011 Contemporary Accounting Research Wiley Online Library

Pdf Analyst Coverage And Earnings Management

The Value Of Crowdsourced Earnings Forecasts Jame 2016 Journal Of Accounting Research Wiley Online Library

Pdf Ifrs Adoption Corporate Governance And Management Earnings Forecasts

Pdf Corporate Governance And Earnings Management A Survey Of Literature

Comments

Post a Comment